Scalping – Forex Trading Strategies

Support and Resistance Levels – Forex Trading Strategies

Trend Trading – Forex Trading Strategies

Trading Moving Averages – Forex Trading Strategies

How to Trade Profitably in Volatile Markets – Forex Trading Strategies

Multiple Time Frames – Forex Trading Strategies

Trading the Central Banks – The Rhetoric – Forex Trading Strategies

Trading the Central Banks – The Actions – Forex Trading Strategies

The Right Strategy in an Irrational Market – Forex Trading Strategies

Understanding Forex and Letting the Market Guide You – Forex Trading Strategies

Long-Short Hedging Strategy – Forex Trading Strategies

Forex trading strategies that work #1 — Position trading

Position trading is a longer-term trading approach where you can hold trades for weeks or even months.

The timeframes you’ll trade on are usually the Daily or Weekly.

As a position trader, you mainly rely on fundamental analysis in your trading (like NFP, GDP, Retail sales, and etc.) to give a bias.

Also, you might use technical analysis to better time your entries.

Let’s say:

You analyze the fundamentals of EUR/USD and determine it’s bullish. But, you don’t want to go long at any price.

So, you wait for EUR/USD to come to Support before taking your position.

Now if your analysis is correct, you could enter at the start of a new trend before anyone else.

An example:

Now, let’s discuss the pros and cons of position trading…

The pros:

- Don’t need to spend much time trading because your trades are longer-term

- Less stress in your trading as you’re not concerned with the short-term price fluctuations

- A favorable risk to reward on your trades (possibly 1 to 5 or more)

The cons:

- Require a firm understanding of fundamentals driving the market

- Need a larger capital base because your stop loss is wide

- May not make a profit every year because of the low number of trades

And lastly…

There’s a trading strategy called Trend Following (which is similar to position trading).

The only difference is Trend Following is purely a technical approach that doesn’t use any fundamentals.

Forex trading strategies that work #2 — Swing trading

Swing Trading is a medium-term trading strategy where you can hold trades for days or even weeks.

The timeframes you’ll trade on are usually the 1-hour or 4-hour.

As a swing trader, your concern is to capture “a single move” in the market (otherwise called a swing).

So you’ll likely:

- Buy Support

- Sell Resistance

- Trade breakouts

- Trade pullbacks

- Trade the bounce of the moving average

Here’s an example of swing trading on USD/JPY:

Now, let’s discuss the pros and cons of swing trading…

The Pros:

- Don’t have to quit your full-time job to be a swing trader

- It’s possible to be profitable every year because you have more trading opportunities

The Cons:

- Won’t be able to ride big trends

- Have overnight risk

Forex trading strategies that work #3 — Day trading

Day trading a short-term trading strategy where you’ll hold your trades for minutes or even hours (it’s similar to swing trading but at a “faster” pace).

The timeframes you’ll trade on are usually the 5mins or 15mins.

As a day trader, your concern is to capture the intraday volatility.

This means you must trade the most volatile session of your instrument because that’s where the money is made.

So, you’ll likely:

- Buy Support

- Sell Resistance

- Trade breakouts

- Trade pullbacks

- Trade the bounce of the moving average

Now…

If you’re a day trader, you won’t be concerned with the fundamentals of the economy or the long-term trend because it’s irrelevant.

Instead, you’ll identify your bias for the day (whether to be long or short) and trade that direction for the session.

An example:

Below is the chart of USDCAD (4-hour timeframe) at 1.2900 Resistance.

If the price can’t break above it, chances are, today will be a “down” day.

Next…

On the 15-minute timeframe, you noticed a Shooting Star has formed which signals selling pressure.

You can take a short trade with possible target profit at Support (blue box).

Here’s what I mean:

Now, let’s discuss the pros and cons of day trading…

The pros:

- If you’re good, you can make money on most months

- No overnight risk because you close your positions by the end of the day

The cons:

- It’s stressful as you’re constantly watching the markets

- Can lose a lot more than intended if you suffer massive slippage (from Black Swan events)

- Huge opportunity cost as you could be earning a full-time salary elsewhere

Now if day trading is still too “slow” for you, then the next forex trading strategy might suit you…

Forex trading strategies that work #4 — Scalping

Warning:

I don’t recommend scalping for the retail traders because the transaction cost will eat up most of your profits.

And you’re slower than the machines which put you at a major disadvantage.

Still, if you want to learn more, then read on…

Scalping is a very short-term strategy where you’ll hold trades minutes or even seconds.

As a scalper, your concern with what the market is doing now and how you can take advantage of it.

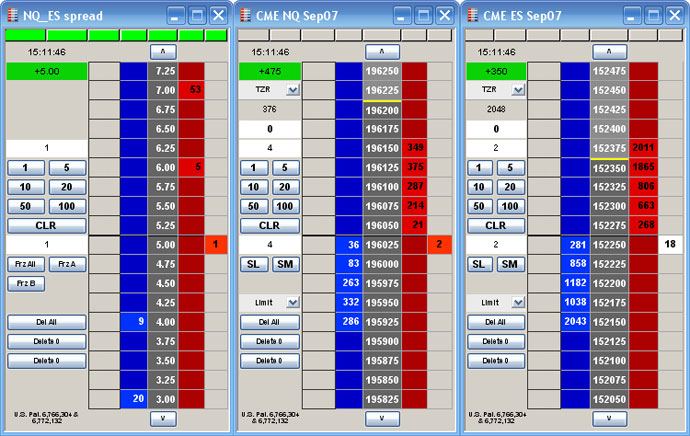

The main tool you’ll use to trade is order flow (which shows you the buy and sell orders in the market).

An example:

Now, let’s discuss the pros and cons of scalping…

The pros

- Have lots of trading opportunities each day

- Can make a healthy income from trading

The cons

- High financial cost (paying your software, newsfeed, connection, and etc.)

- Glued to the screen for many hours a day

- It’s a highly stressful endeavor

Forex trading strategies that work #5 — Transition trading

You’ve probably never heard of this before because I came up with it.

Here’s how…

Back while I was in proprietary trading, one of the “interesting” things I learned was transition trading.

You’re probably wondering:

“What is transition trading?”

Well, the idea is to enter a trade on the lower timeframe, and if the market moves in your favor, you can increase your target profit or trail your stop loss on the higher timeframe.

Here’s an example:

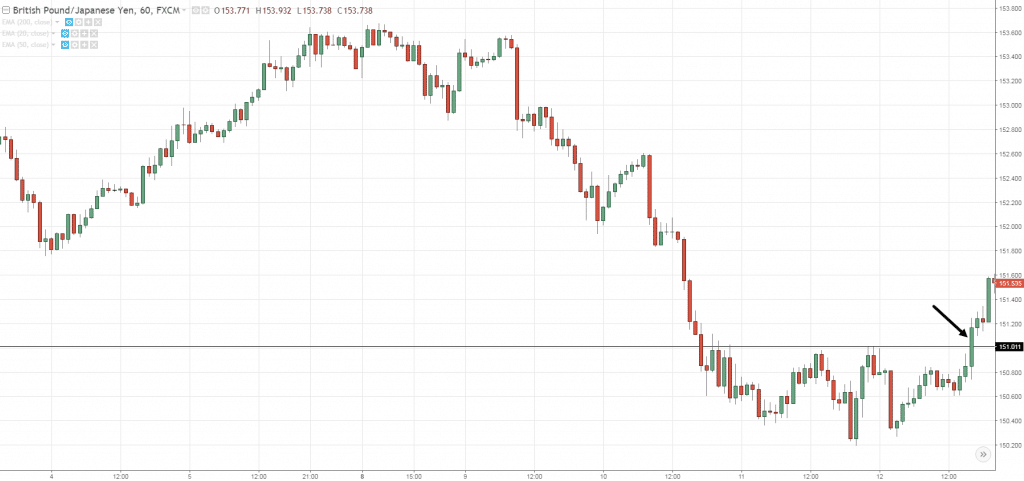

Let’s say you traded the breakout on GBP/JPY 1-hour timeframe and the price quickly went in your favor.

Now…

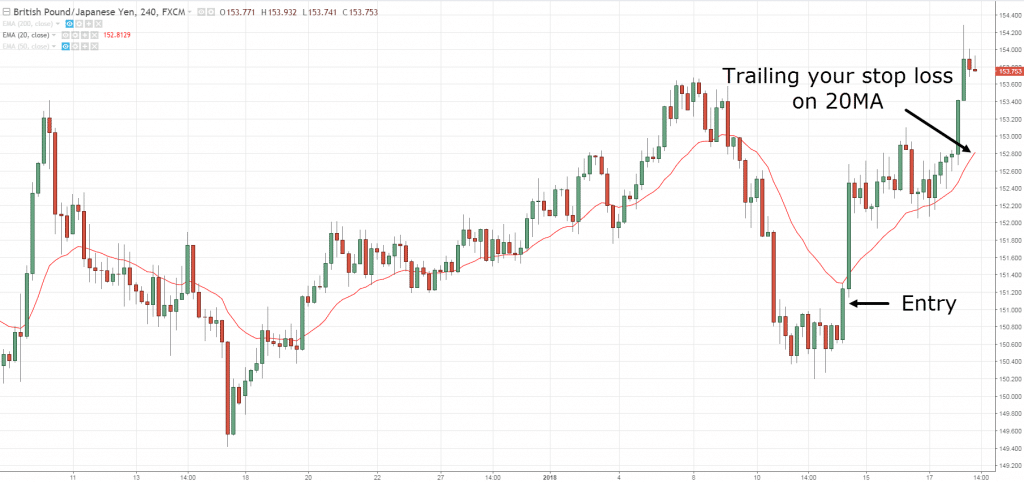

You noticed the 4-hour timeframe respecting the 20MA.

So instead of taking profits, you trail your stop loss using the 20MA hoping to ride a bigger move.

And if you’re wrong, you’ll exit your trade when the price closes below the 20MA.

Now, there are variations of transition trading.

But the main idea is this:

- Find an entry on the lower timeframe

- If the price moves in your favor, consider planning your exits on the higher timeframe

Now, let’s discuss the pros and cons of transition trading…

The pros:

- Can get an insane risk to reward (possibly 1 to 10 or more)

- Can lower your risk as your entry is on the lower timeframe

The cons:

- Only a handful of your trades will lead to monster winners

- Must understand multiple time frames really well

Now that you have an idea of the different forex trading strategies out there.

The next question is…

Which Forex trading strategies suit you best?

Here’s the thing:

I’ve seen traders wasting many years on trading strategies that don’t suit them (right from the start).

If ONLY they considered these 3 things I’m about to share with you…

…they could have saved years of frustrations, money, time, and effort.

And, I don’t want you to be one of them.

So before you attempt to trade any forex trading strategies, you MUST consider these 3 questions…

1. Do you want to grow your wealth or make an income from trading?

First, let’s define what’s income and wealth.

Income = Make X dollars a month

Wealth = Grow X % a year

For income:

If you make an income from trading, you must find more trading opportunities within a shorter time period (for the law of large number to play out).

This means you must trade the lower time frames and spend more hours in front of the screen.

The Forex trading strategies you can use are scalping, day trading, or short-term swing trading.

For wealth:

If you want to grow your wealth from trading, you can afford to have fewer trading opportunities.

This means you can trade the higher time frames and spend fewer hours in front of the screen.

The trading strategies you can use are swing trading or position trading.

2. How much time can you devote to trading?

This is a no-brainier.

But I’ve included it because I’ve seen traders who can’t think logically (not you of course).

So here’s the deal:

If you have a full-time job, or you can’t afford to spend 12 hours a day in front of your monitor, then don’t try scalping or day trading (it’s silly).

Instead, go with swing or position trading.

But, if you have all the time in the world and enjoy short-term trading, by all means, go ahead.

3. Does this Forex trading strategy suit you?

Here’s the breakdown:

Most trading strategies will fall into 1 of 2 categories:

- A high win rate with low reward to risk

- A low win rate with high reward to risk

So a better question would be…

“Which approach are you more comfortable with?”

If you prefer a higher winning rate but smaller gains, then go for swing trading.

If you prefer a lower winning rate but larger gains, then go for position trading.

Conclusion

Here’s a recap of the different forex trading strategies that work:

Position trading: A wealth building approach for those who can’t spend the whole day in front of the screen

Swing trading: A wealth or income building approach for those who can spend a few hours each day trading

Day trading and scalping: An income generating approach for those who can spend the whole day in front of the screen

And finally…

Before you learn any forex trading strategies, you must consider…

- Your trading goals

- Your time available

- Whether the strategy fits your personality